Your donations are tax deductable, calculate your tax benefit

Enter your donation amount

to estimate your potential tax benefit.

Your donations are tax deductable, calculate your tax benefit

Enter your donation amount

to estimate your potential tax benefit.

If you donate

On a before tax income of

The actual cost of your donation is

Because you save

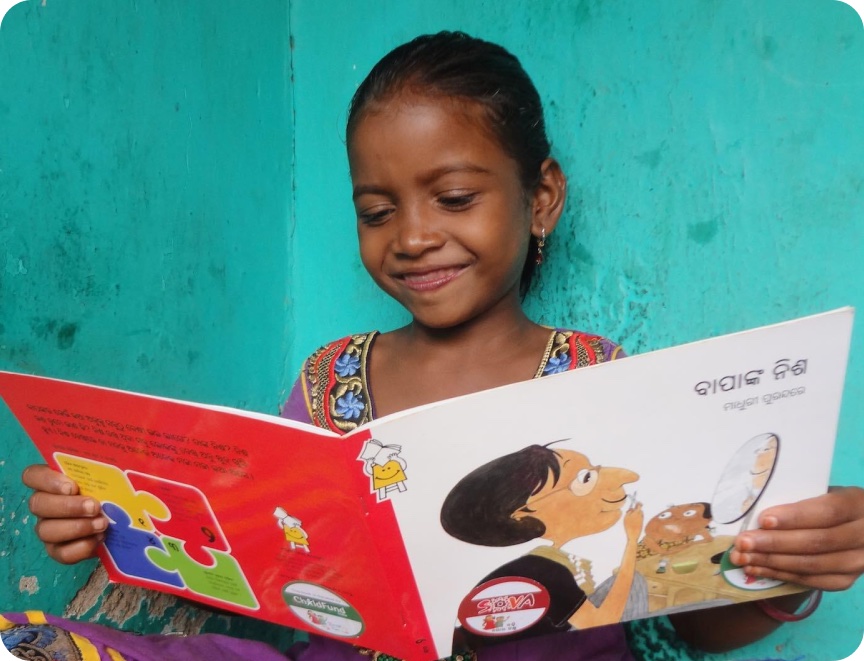

Chenda is being denied her chance to learn.

The reason is out of her control.

This happens every day.

A quality education is every girl’s right. Unfortunately it’s not every girl’s reality.

Twelve-year-old Chenda from Cambodia was in Grade 2 when she learned that her family couldn’t afford to keep her in school.

Her parents went to neighbouring Thailand in search of work, and Chenda went to live with her grandfather.

Instead of going to school, Chenda started to do chores at home instead to pass the time.

“I wanted to go to school like other children,” Chenda said. “After doing housework, I had nothing to do. I was unhappy.”

There are millions of girls around the world who face barriers keeping them from school, such as poverty, conflict, a lack of hygiene facilities, poor learning experiences, and sometimes harmful views about gender.

Chenda wanted to stay in school, but her parents couldn’t afford books, uniforms, or transport to get her there and back.

While Chenda’s mum went looking for a job to bring more income to the family, Chenda worked in her grandfather’s house, missing her opportunity to learn and play at school.

“Now, I must help my grandfather with the housework, cooking and chopping firewood,” she said.

“Sometimes I struggle to use the axe. Sometimes I burn my hand when I start the fire.”

Girls like Chenda should be in school. Poverty shouldn’t be a reason they are denied an education.

You can help girls transform their future.

“I wanted to go to school like other children.”

– Chenda, age 12

Girls who are not in school are more likely to remain in poverty. They are also at a greater risk of sexual exploitation, forced or early marriage, and gender based

violence.

Sadly, the impacts of the pandemic, climate change and economic instability on developing communities has increased the number of girls leaving school early, or not attending at all.

Without intervention right now, thousands of girls could lose their opportunity to build a brighter future for themselves through education.

Investing in education is one of the very best ways to help girls in developing communities stay safe, break the cycle of poverty and build better lives for themselves and their families.

Twelve-year-old Chenda is proof of the difference you can make with a donation to ChildFund.

Thanks to the support of people like you, ChildFund’s partner on the ground in Cambodia, and the work of her school, Chenda was able to resume her learning.

ChildFund with local partners, helped with some financial support, and after a year of missed school, a delighted Chenda went back.

“I was very happy the day my grandfather told me the teacher had asked him to send me back. ChildFund helped me with learning materials. I have a school bag, pen, writing book, pencil, shoes, and school uniform,” Chenda told us.

Make a life-changing donation today.

It took a village

to get Chenda to school.

Here’s how your donation can

help children

YOU’LL IMPROVE SCHOOLS AND FUND STUDY MATERIALS.

You can make schools safer for girls by helping to provide clean water and girls’ toilets so they do not have to go out into nature or open spaces.

Your donation will also help pay for uniforms, shoes, books and other school supplies to help them learn and live up to their potential.

YOU’LL HELP TRAIN TEACHERS AND TUTORS.

Your support will help give teachers the skills they need to make their classrooms safe and their lessons fun and engaging. Teachers will learn about positive discipline, gender equality and inclusion.

Your gift will also help support peer tutor programs so no child is left behind in their learning.

YOU’LL SHOW GIRLS, AND THEIR FAMILIES, WHY LEARNING MATTERS.

To help girls go to school, and get out of poverty, their families and community leaders need to value

their right to an education.

Your donation will help ChildFund and our local partners work with communities to change outdated

views on educating girls.

PLEASE HELP MORE GIRLS GO TO SCHOOL – AND BREAK THE CYCLE OF POVERTY.

Please donate generously.

Girls Are Being Denied An Education

Frequently Asked Questions

Complete the form below to subscribe to our newsletter.

If you’re filing your tax return for the first time, have never claimed donations or donated at all, you’re probably wanting to know more about how you can claim donations to charity on your taxes. We’ve answered some of the most important questions about tax deductible donations below.

Tax deductible donations are about giving back, to get back. Donating to ChildFund Australia will help children in urgent need of support. You’ll be helping the most vulnerable children across South East Asia and Africa, and you yourself will be able to receive a greater refund on your tax return.

You can submit any tax deductible donation over $2 as part of your tax return.

You can only claim for donations which are monetary gifts, given without the promise of something in return. Raffle tickets, charity chocolates, events and other donations of this kind, are not tax deductible.

At ChildFund, all regular giving donations over $2 are tax deductible including child sponsorship, community sponsorship and donations to appeals. A few donation categories are not tax deductible, for example, birthday gifts to your sponsored child and are not included on your annual tax receipt.