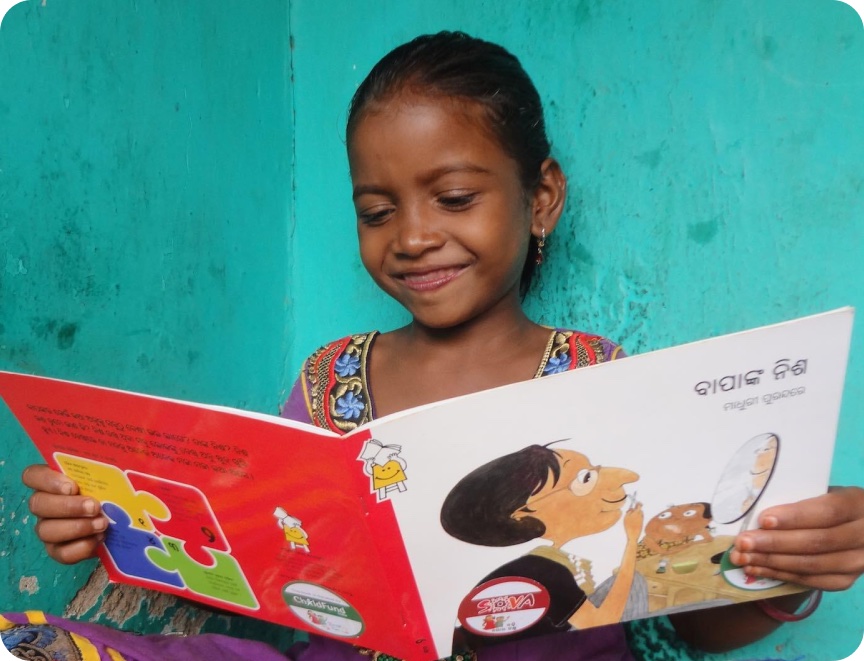

This back to school season, you’ve got the chance to make a huge difference for children like Sofia.

In Timor-Leste, 70% of kids are leaving school before Year 9. But you can help turn this around – ensuring children have what they need to succeed in school.

The solution to this problem is so simple – and so effective. With the help of generous supporters like you, we’re training volunteers to run reading programs in local communities. And it’s working!

The early years are key

Research shows that children who can’t read well by Year 3 are four times more likely to drop out of high school. For children like Sofia, all it takes is learning to read. But we can’t do it without you.

Why it matters

91.5% of children in Timor-Leste enrol in primary school. But 70% drop out by Year 9.

70% of Year 1 readers are scoring at the lowest level

for reading.

Almost half of all kids in Timor-Leste are at least 2 grades behind in school.

Frequently Asked Questions

Complete the form below to subscribe to our newsletter.

If you’re filing your tax return for the first time, have never claimed donations or donated at all, you’re probably wanting to know more about how you can claim donations to charity on your taxes. We’ve answered some of the most important questions about tax deductible donations below.

Tax deductible donations are about giving back, to get back. Donating to ChildFund Australia will help children in urgent need of support. You’ll be helping the most vulnerable children across South East Asia and Africa, and you yourself will be able to receive a greater refund on your tax return.

You can submit any tax deductible donation over $2 as part of your tax return.

You can only claim for donations which are monetary gifts, given without the promise of something in return. Raffle tickets, charity chocolates, events and other donations of this kind, are not tax deductible.

At ChildFund, all regular giving donations over $2 are tax deductible including child sponsorship, community sponsorship and donations to appeals. A few donation categories are not tax deductible, for example, birthday gifts to your sponsored child and are not included on your annual tax receipt.