Cha-Ching! Laos youth get money savvy

14 July 2024

•By efreedman

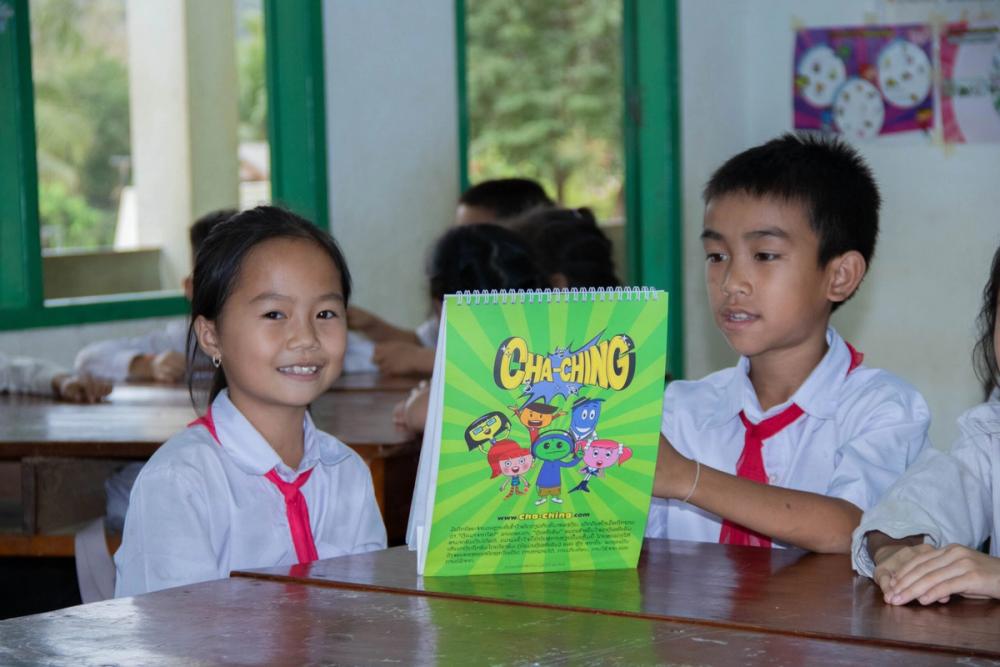

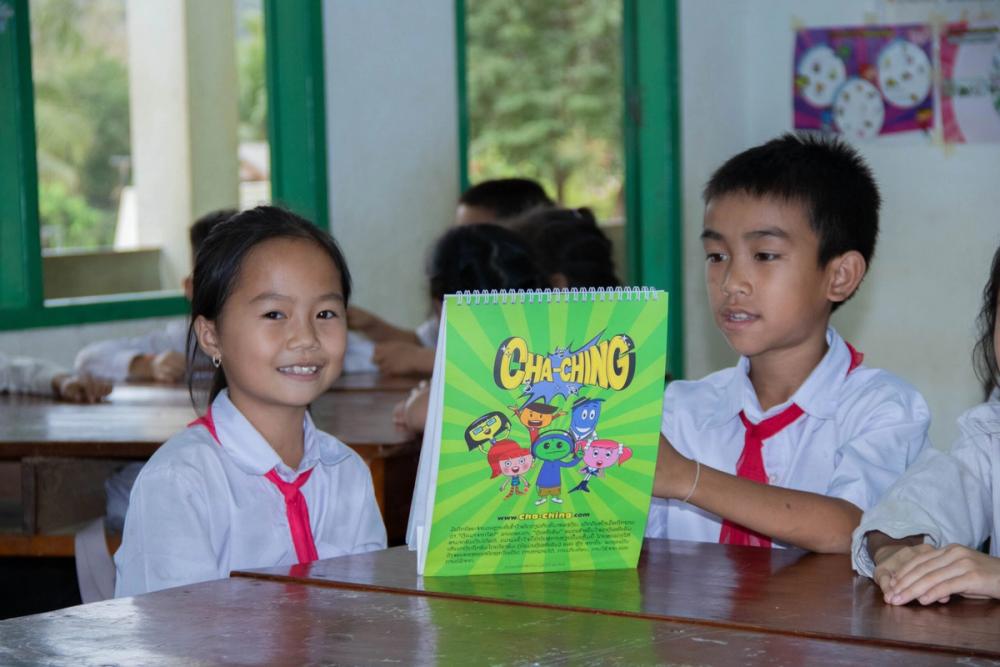

Today is the 10th anniversary of ! To celebrate, we’re spotlighting the importance of financial literacy for young people in building a more peaceful, prosperous and sustainable future. In rural Laos, a ChildFund-supported financial literacy program is empowering students to make informed choices, manage their money and navigate economic uncertainty.

World Youth Skills Day

What we learn in our formative years can prepare us for future success. This is especially true for matters relating to personal finances. Knowing how to budget, spend wisely and understand the ins and outs of money is, quite literally, an investment for the future – it can increase opportunities and financial security later in life. In rural Laos, a lack of knowledge and skills around money, coupled with their financial rights, has led to poor decision-making. Young people are vulnerable to workplace exploitation (not earning minimum wage or being discriminated against due to gender or both) and more likely to seek income opportunities abroad, often a lifeline to households in poor rural areas, to help support their families. Financial literacy was identified as a critical issue among the youth at the annual National Children's Forum in Laos. They emphasised the need for economic education so that young people would have the skills to manage their money, avoid instability and prepare for the future. It is essential for the financially vulnerable, as they can easily fall into debt traps, reinforcing the cycle of poverty. To bridge the equity gap, ChildFund in Laos, with support from the Prudence Foundation and local partners, introduced the Cha-Ching program, a comprehensive financial literacy curriculum for schools in rural Laos. The program focuses on four financial concepts (earning, saving, spending, and donating) to help young people make informed decisions about their money and resources.

Cha-Ching!

"Before the program, students spent all their money on whatever they wanted. They didn't know how to save or earn money.” Khambang, a primary school teacher in Houaphanh Province, says she has seen positive changes in students’ behaviour since she began incorporating the Cha-Ching program into her school’s curriculum. She has noticed that students are now more aware of the value of a Lao Kip (the official currency in Laos) and how to make it stretch. Students like Phommalin (10), have learnt how to earn money, save wisely for the future, spend responsibly, and donate to those in need. While they may spend money on treats occasionally, students have reduced mindless spending or budgeted for ‘extras’.

" I now know how to compare prices, distinguish between wants and needs, save money in piggy banks, save more, and spend less."

“After joining the Cha-Ching program, I learnt to use money wisely,” says Phommalin. “I now know how to compare prices, distinguish between wants and needs, save money in piggy banks, save more, and spend less.” This new knowledge has led to positive changes in children’s behaviours outside the classroom, says Khambang, who has received positive feedback from parents. “One day, a parent came to school and told me they were very proud of their child and the Cha-Ching program. Their child no longer asks for unnecessary items or pressures them to buy things like before. When he has money, he either doesn’t spend it or spends very little, choosing to save more instead. When his piggy bank is full, he asks his parents to take him to the bank to deposit his savings."

Saving up for a rainy day – or a big dream!

Students are learning to save, dreaming bigger, and finding ways to earn more money. Dok Ngern (9), a student in the Cha-Ching program, has developed her own method to support her family. She earns a wage by helping her parents harvest vegetables for sale and diligently saves in her piggy bank. "I've been helping my parents with their work so I can save money to buy an electric bike for riding to school. I'm really happy that I've saved up all by myself!" she says. Through the Cha-Ching program, students like Dok Ngern are empowered to set goals and take actionable steps toward achieving them, fostering financial literacy and a sense of responsibility.

A brighter, more financially secure future

Staying financially afloat during life’s ups and downs requires the right resources and support – and a lot of forward thinking. Through the Cha-Ching program, and support of teachers like Khambang, students in rural Laos now have greater financial awareness, and are better prepared for their transition into adulthood.

Learn more about our programs in Laos.