Are staff Christmas gifts tax deductible?

As we draw closer to the festive season and Christmas shopping is underway, you’ve probably got your thinking cap on in regard to maximising your budget for gifts. Did you know that in certain circumstances Christmas gifts are actually tax deductible?

As an employer, you can provide tax deductible gifts to staff, clients and vendors. Conditions around tax deductible Christmas gifts change regularly, so we encourage you to check the latest information provided by the ATO.

Gifting charity donations for Christmas, however, is an option open to everyone, with fewer requirements to meet to boost your tax return.

When is a donation to charity given as a Christmas gift considered tax deductible?

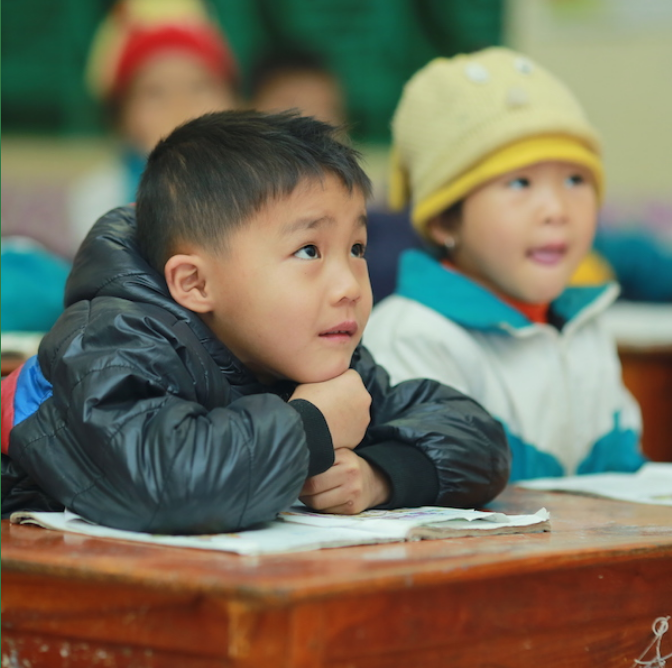

Of all the Christmas gifts you could choose to give this year, charity donations will give back to families in need, as well as boost your next tax return.

For a charity donation to be considered tax deductible, it must be in an amount of more than $2, and not be given to a charity in exchange for goods or benefits (raffle tickets, entry to an event etc). The charity must also be endorsed as a Dedicated Gift Recipient by the ATO, and your receipt for the donation provided to prove your gift meets these requirements.

This means that when you choose a charity donation as a Christmas gift to staff or clients, your business is contributing towards its social responsibility portfolio, making a difference for families in need and taking the opportunity to give a meaningful and personalised gift to a valued member of your team. Charity gifts are a win for everyone involved!

When is a Christmas gift to staff considered tax deductible?

For a Christmas gift to be tax deductible, it must be gifted by a business entity to a staff member, client or vendor under certain conditions.

Gifts that are considered by the ATO to be “entertainment” fall under different conditions to those that are not, so we will address the two types of gifts and the tax benefits businesses can leverage separately.

Are Christmas gifts that are considered to be “entertainment” tax deductible?

Christmas gifts that the ATO consider to be entertainment include tickets to theatre performances, sporting events and concerts. Cinema tickets, airline tickets and other forms of event-based activities also fall within the category of entertainment.

Entertainment gifts that cost $300 or more are tax deductible, but they are also subject to Fringe Benefit Tax (FBT), something to keep in mind if you have an extensive client portfolio or staff list you wish to provide with experiential gifts. If, however, you give tickets that are less than $300 in value, they are not tax deductible, but they’re also not subject to FBT.

What about Christmas gifts that aren’t considered “entertainment”?

The conditions for gifts that aren’t considered entertainment are much different, and more likely to earn a business a decent boost to their tax refund.

Material gifts such as chocolates, Christmas hampers and baskets, wines, or fragrances, as well as monetary gifts in the form of vouchers or charity donations are not considered entertainment. Christmas gifts that aren’t entertainment are tax deductible regardless of value, and are only subject to FBT when valued over $300.

Show your appreciation for staff and clients with Christmas gifts that will boost your tax return

Christmas gifts are tax deductible when they meet particular conditions, but they will always boost your tax return when you choose a charity donation.

We encourage you to be creative in your choice and personalise toward the interests of your recipient. Show your appreciation for staff, clients and vendors by thanking them for a great year with a donation to charity for Christmas, an act of hope and kindness for the new year.

Learn more about ChildFund’s range of Gifts for Good by browsing our catalogue. Staff Christmas gift ideas include our ‘Most in Need’ products such as COVID-19 Protection Kits for Families, Food Packs for Families and Safe Sleep Bundles.